If you donate valuable items to charity, you may be required to get an appraisal. The IRS requires donors and charitable organizations to supply certain information to prove their right to deduct charitable contributions. If you donate an item of property (or a group of similar items) worth more than $5,000, certain appraisal requirements apply. You must: get a “qualified appraisal;” attach an “appraisal summary” to the first tax return on which the deduction is claimed; include other information with the return; receive the qualified appraisal before your tax return is due; and maintain certain records. Other rules apply to larger gifts and there are exceptions. Contact us with questions.

Read More...

2022 – 05/02 – Businesses may receive notices about information returns that don’t match IRS records

The IRS has begun mailing notices to businesses and other payers that filed certain returns with information that doesn’t match the agency’s records. These CP2100 and CP2100A notices are sent by the IRS twice a year to payers who filed information returns that are missing a Taxpayer Identification Number, have an incorrect name or have a combination of both. Payers are required to file with the IRS various information returns reporting payments they make to independent contractors, customers and others. These include Form 1099-MISC (Miscellaneous Income) and Form 1099-NEC (Nonemployee Compensation). Contact us if you have questions about filing information returns.

Read More...

You may dream of turning a hobby into a business. You won’t have any tax headaches if your new business is profitable. But what if the enterprise consistently generates losses (deductions exceed income) and you claim them on your tax return? The IRS may step in and say it’s a hobby (an activity not engaged in for profit) rather than a business. Then you’ll be unable to deduct losses. There are 2 ways to avoid the hobby loss rules: 1) Show a profit in at least 3 out of 5 consecutive years (2 out of 7 years for certain horse businesses). 2) Run the venture in such a way as to show that you intend to turn it into a profit-maker, rather than operate it as a hobby. Contact us for more details.

Read More...

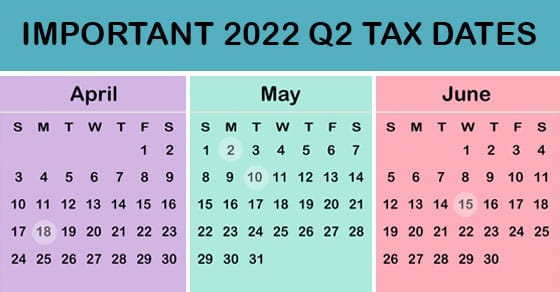

Here are some key tax deadlines for businesses during the second quarter of 2022. APRIL 18: If you’re a calendar-year corporation, file a 2021 income tax return (Form 1120) or file for a six-month extension (Form 7004) and pay any tax due. APRIL 18: Corporations pay the first installment of 2022 estimated income taxes. MAY 2: Employers report income tax withholding and FICA taxes for Q1 2022 (Form 941) and pay any tax due. JUNE 15: Corporations pay the second installment of 2022 estimated income taxes. Contact us to learn more about filing requirements and ensure you meet all applicable deadlines.

Read More...

Businesses typically want to delay taxable income into future years and accelerate deductions into the current year. But sometimes they want to do the opposite. One reason might be tax law changes that raise tax rates. Another reason may be because you expect your pass-through entity to pay taxes at higher rates in the future. There are ways to accelerate income into the current year and delay deductions into later years. For example, sell appreciated assets that have capital gains in this year, rather than waiting until a future year. Or depreciate assets over a number of years rather than claiming big first-year Section 179 deductions or bonus depreciation deductions. Contact us for help.

Read More...