Does your employer offer a 401(k) plan, but you haven’t started participating? Here are the basic features of these plans to illustrate why you should strongly consider it.

Read More...

If you rent your vacation home for less than 15 days during a year, there’s a special tax break. Here are the rules for vacation rentals.

Read More...

Starting next year, employers with certain retirement plans can allow staff members to contribute to pension-linked emergency savings accounts. Here’s how they work and who can contribute.

Read More...

You want to be able to deduct business expenses on your tax return. But in order to be deductible, expenses must be ordinary, necessary and reasonable. Here are the rules.

Read More...

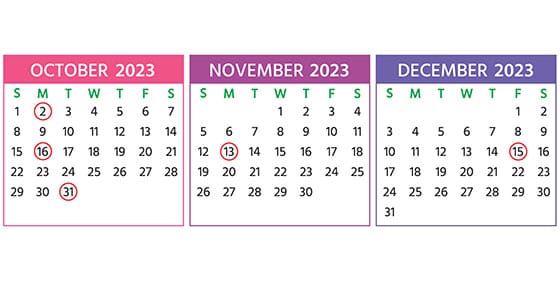

The leaves are beginning to turn in some areas so it’s time for businesses to start thinking about year-end tax strategies. It’s also a good time to think about the fourth quarter 2023 tax filing deadlines.

Read More...