With Labor Day in the rearview mirror, it’s time to take proactive steps that may help lower your business’s taxes for 2024 and 2025. The strategy of deferring income and accelerating deductions to minimize taxes can be effective for most businesses, as is the approach of bunching deductible expenses into this year or next to maximize their tax value. Other ideas: Buy eligible equipment and place it in service by […]

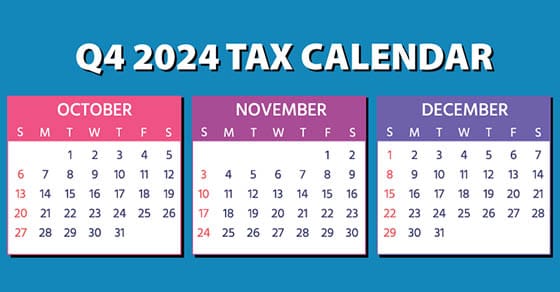

Read More...Here are some important fourth quarter 2024 tax-filing dates for businesses. OCT 15: If you’re the owner or operator of a calendar-year C corp. which filed an extension, file a 2023 income tax return. OCT 31: Report income tax withholding and FICA taxes for Q3 2024 (unless you’re eligible for a Nov. 12 deadline because you deposited on time, and in full, all the associated taxes due). DEC 16: If […]

Read More...For many businesses, a limited liability company (LLC) is an enticing choice. It can be structured to resemble a corporation for owner liability purposes and a partnership for federal tax purposes. This may provide the owners with several advantages. Like corporate shareholders, LLC owners or members generally aren’t liable for business debts except to the extent of their investment. Plus, there may be tax benefits. For example, earnings aren’t subject […]

Read More...If you’re a business owner working from home or an entrepreneur with a side gig, you may qualify for home office deductions. On the other hand, employees who work remotely can’t deduct home office expenses under current federal tax law. To be eligible for a deduction, you must use part of your home regularly and exclusively as your principal place of business, or a place to meet with customers, clients […]

Read More...Many businesses have a choice between using the cash or accrual method of accounting for tax purposes. The cash method often provides significant tax benefits for businesses that qualify, but some may be better off using the accrual method. Cash-basis businesses recognize income when it’s received and deduct expenses when they’re paid, so they have greater control over the timing of income and deductions. In contrast, accrual-basis businesses recognize income […]

Read More...